|

|

| Rating: 4.2 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: PayPal, Inc. |

The Venmo app has revolutionized the way people transfer money and split expenses. Developed by PayPal, Venmo offers a convenient and secure platform for sending and receiving payments among friends, family, and even businesses. With its user-friendly interface and social elements, Venmo has become immensely popular, making financial transactions more accessible and enjoyable.

Venmo simplifies the process of sending money to individuals or groups. Whether you’re splitting a dinner bill, paying rent to a roommate, or chipping in for a gift, Venmo provides a seamless way to handle these transactions. The app’s social features also add an element of fun and engagement, allowing users to like and comment on transactions, adding a social media-like experience to their financial interactions.

Features & Benefits

- Easy Fund Transfers: Venmo enables users to transfer funds quickly and easily to others. Whether it’s sending money to a friend, paying back a loan, or receiving payments, Venmo simplifies the process with just a few taps. Users can link their bank accounts, debit cards, or credit cards to Venmo for seamless fund transfers.

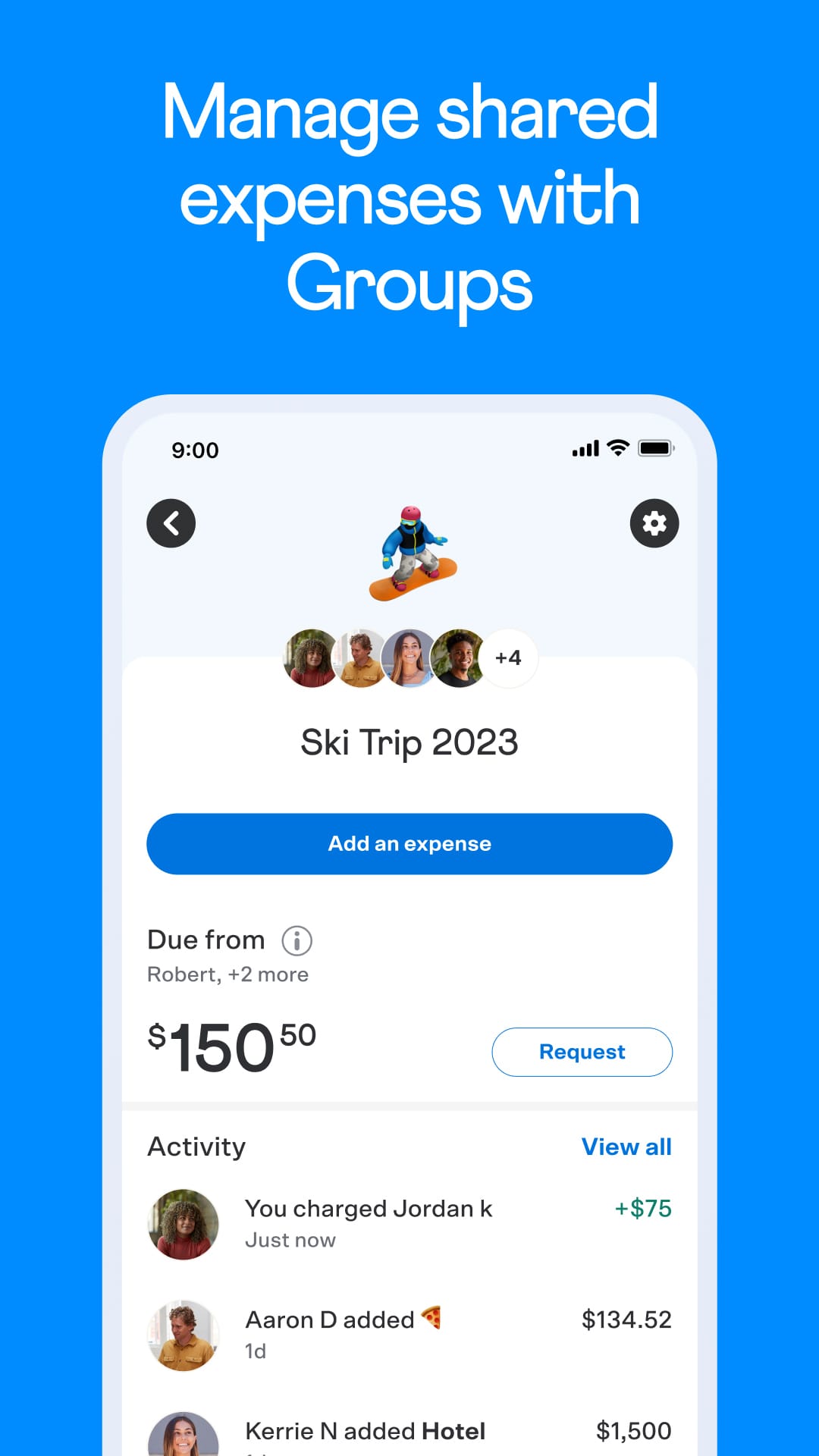

- Splitting Expenses: Venmo makes it effortless to split expenses among friends or groups. Users can create a payment request and divide the cost of meals, utilities, or shared expenses. Venmo keeps track of who paid what and sends reminders to participants, ensuring smooth coordination and settling of bills.

- Social Interactions: Venmo incorporates social elements that add a fun and interactive touch to financial transactions. Users can like and comment on payments, adding emojis and personalized messages. This feature creates a social network-like environment, making payments more engaging and enjoyable.

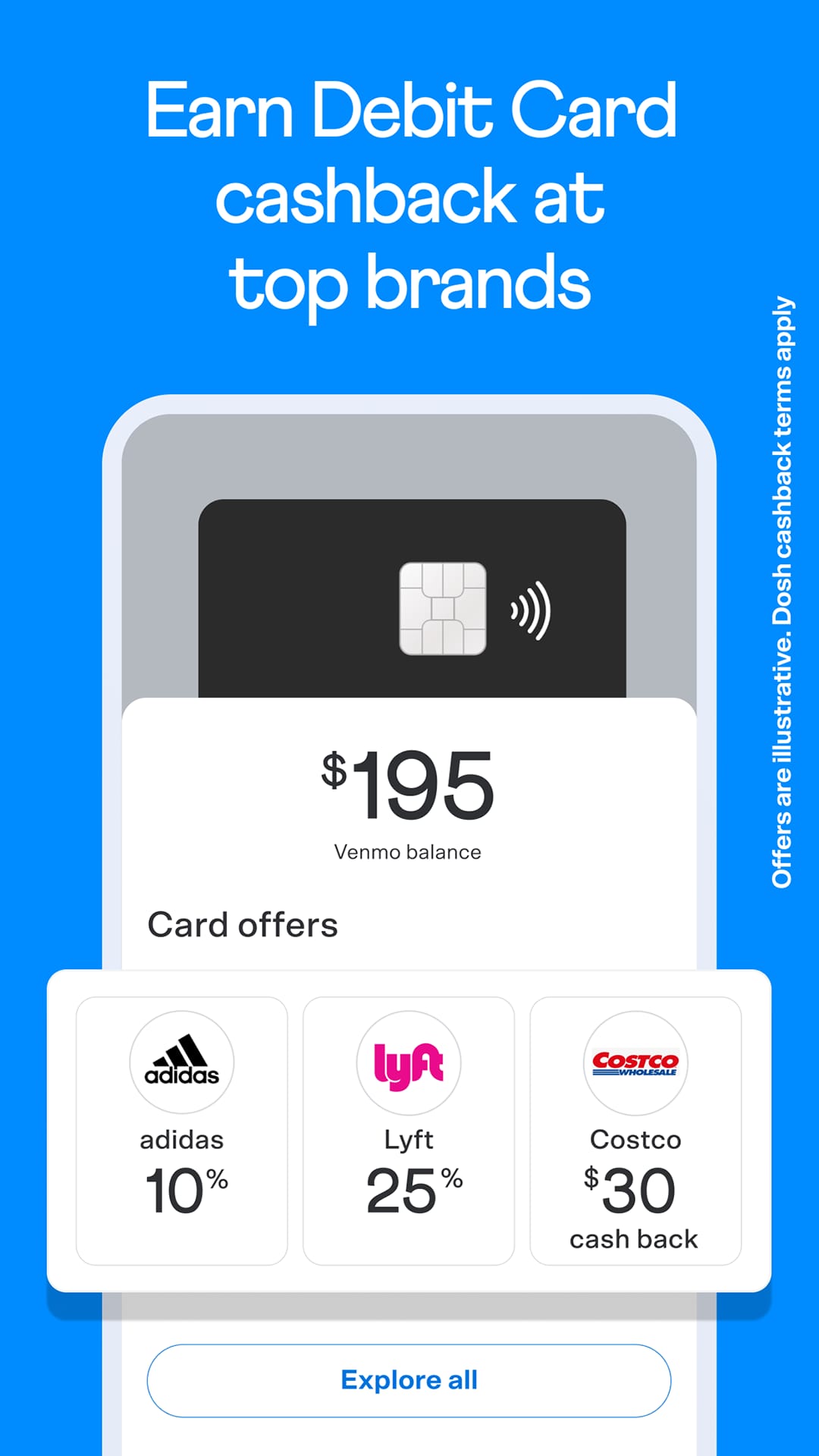

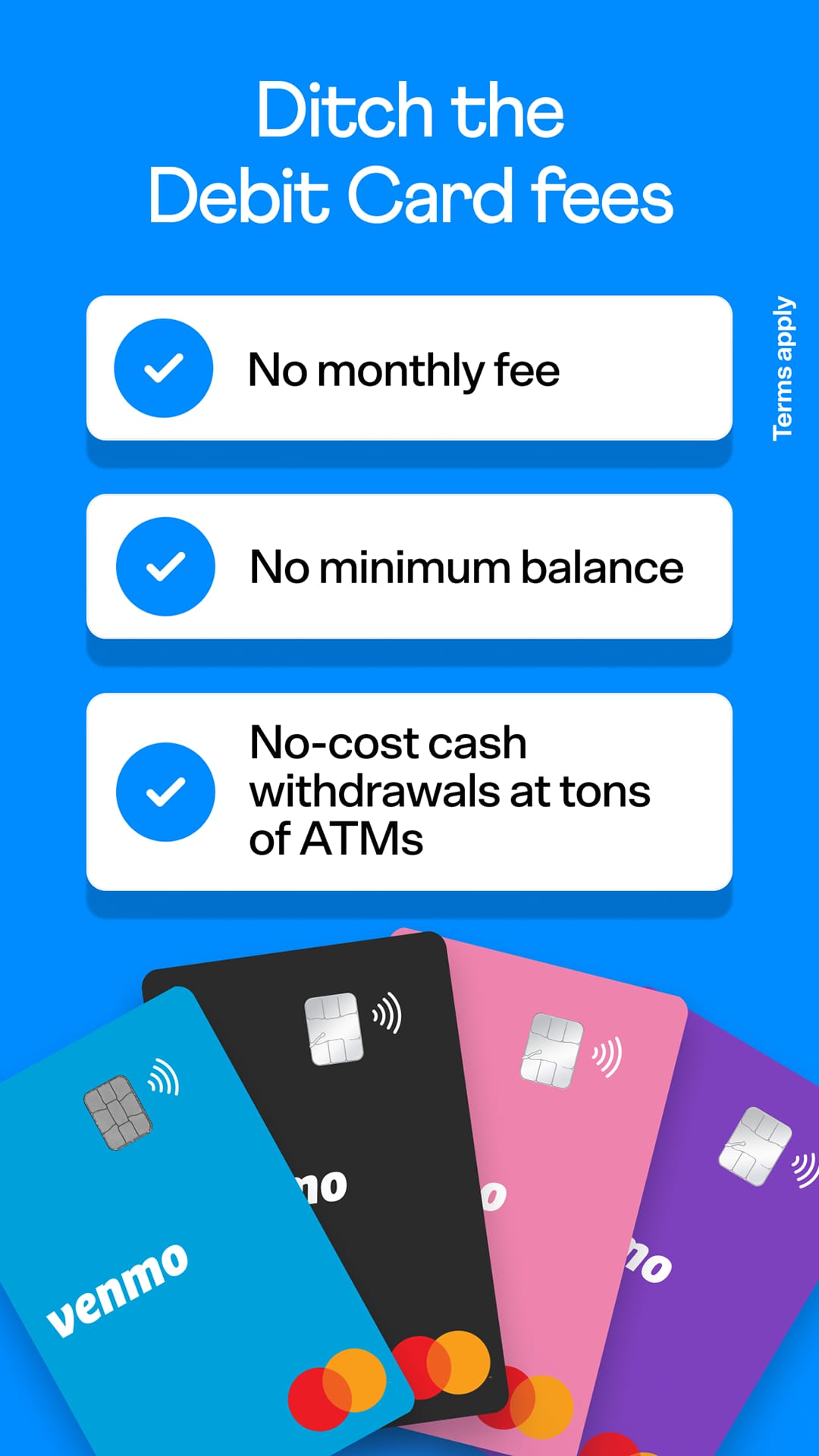

- Venmo Card: Venmo offers a physical Venmo debit card that allows users to make purchases using their Venmo balance. The card can be used wherever Mastercard is accepted, providing users with a convenient and secure payment option, both online and in physical stores.

- Security and Privacy: Venmo prioritizes the security and privacy of its users. The app utilizes encryption and multi-factor authentication to protect financial information. Users also have control over their privacy settings, including the ability to choose who can see their payment activity.

Pros

- Convenient Peer-to-Peer Payments: Venmo makes it incredibly convenient to send and receive money from friends, family, or acquaintances, eliminating the need for cash or checks.

- Social and Interactive Payment Experience: The app’s social feed feature adds a unique and fun element to transactions, creating a more engaging and interactive payment experience.

- Simplified Expense Splitting: Venmo simplifies the process of splitting bills among friends or roommates, making it easy to keep track of shared expenses and settle payments within the app.

- Seamless Integration with Bank Accounts: The app integrates smoothly with users’ bank accounts, debit cards, and credit cards, allowing for easy transfers and access to funds.

- Security and Buyer Protection: Venmo prioritizes the security of users’ financial information and provides buyer protection for eligible transactions, offering peace of mind when making payments.

Cons

- Limited International Availability: Venmo is primarily available for users within the United States, limiting its accessibility for international transactions or users outside the supported regions.

- Transaction Limits and Fees: Venmo imposes certain transaction limits and fees for specific types of transfers, such as instant transfers or transfers to non-linked bank accounts, which may be a consideration for heavy users.

- Privacy Concerns: Venmo’s social feed feature, while adding a social element, may raise privacy concerns for users who prefer to keep their payment activity private or restrict visibility to a limited audience.

- Dependence on Network Connectivity: The app requires a stable internet connection to perform transactions, which may pose challenges in areas with limited or unreliable network coverage.

- Limited Merchant Acceptance: While Venmo is widely accepted among individuals, merchant acceptance may vary, and not all businesses or online platforms may support Venmo as a payment option.

Apps Like Venmo

Cash App: Cash App, developed by Square, provides a peerto-peer payment service that allows users to send and receive money quickly. It also offers features like a Cash Card for making purchases and investing in stocks.

Zelle: Zelle is a digital payment network that enables users to send money directly to bank accounts in the United States. It is often integrated into banking apps, making it convenient for users to transfer funds.

Google Pay: Google Pay allows users to send money, make online purchases, and store loyalty cards. It also offers contactless payment options through NFC technology, making it easy to pay with a smartphone.

Screenshots

|

|

|

|

Conclusion

Venmo has transformed the way we handle financial transactions among friends, family, and businesses. With its easy fund transfers, expense splitting capabilities, social interactions, Venmo debit card, and robust security measures, the app offers a convenient and enjoyable platform for managing finances. While it has certain limitations, such as its focus on the United States and transaction fees, Venmo remains a popular choice for individuals seeking a seamless and interactive payment solution.