|

|

| Rating: 4 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Early Warning Services, LLC |

The Zelle app has revolutionized the way we transfer money, providing a seamless and convenient platform for sending and receiving funds. Developed in partnership with major banks in the United States, Zelle offers a secure and fast way to make payments directly from your bank account. With its widespread adoption and user-friendly interface, Zelle has become a go-to app for individuals looking to simplify their financial transactions.

Zelle eliminates the need for cash or checks by enabling users to send money digitally. Whether you’re splitting a bill, paying back a friend, or sending money to family, Zelle streamlines the process with just a few taps on your smartphone. With its integration into various banking apps, Zelle offers a hassle-free experience, allowing users to send and receive money with ease.

Features & Benefits

- Instant Money Transfers: Zelle provides users with instant fund transfers, allowing recipients to receive money directly into their bank accounts within minutes. This eliminates the need for traditional payment methods that may take days to process.

- Broad Bank Integration: Zelle collaborates with major banks in the United States, making it easily accessible to a wide range of users. The app is often integrated into banking apps, simplifying the process of sending and receiving money for account holders.

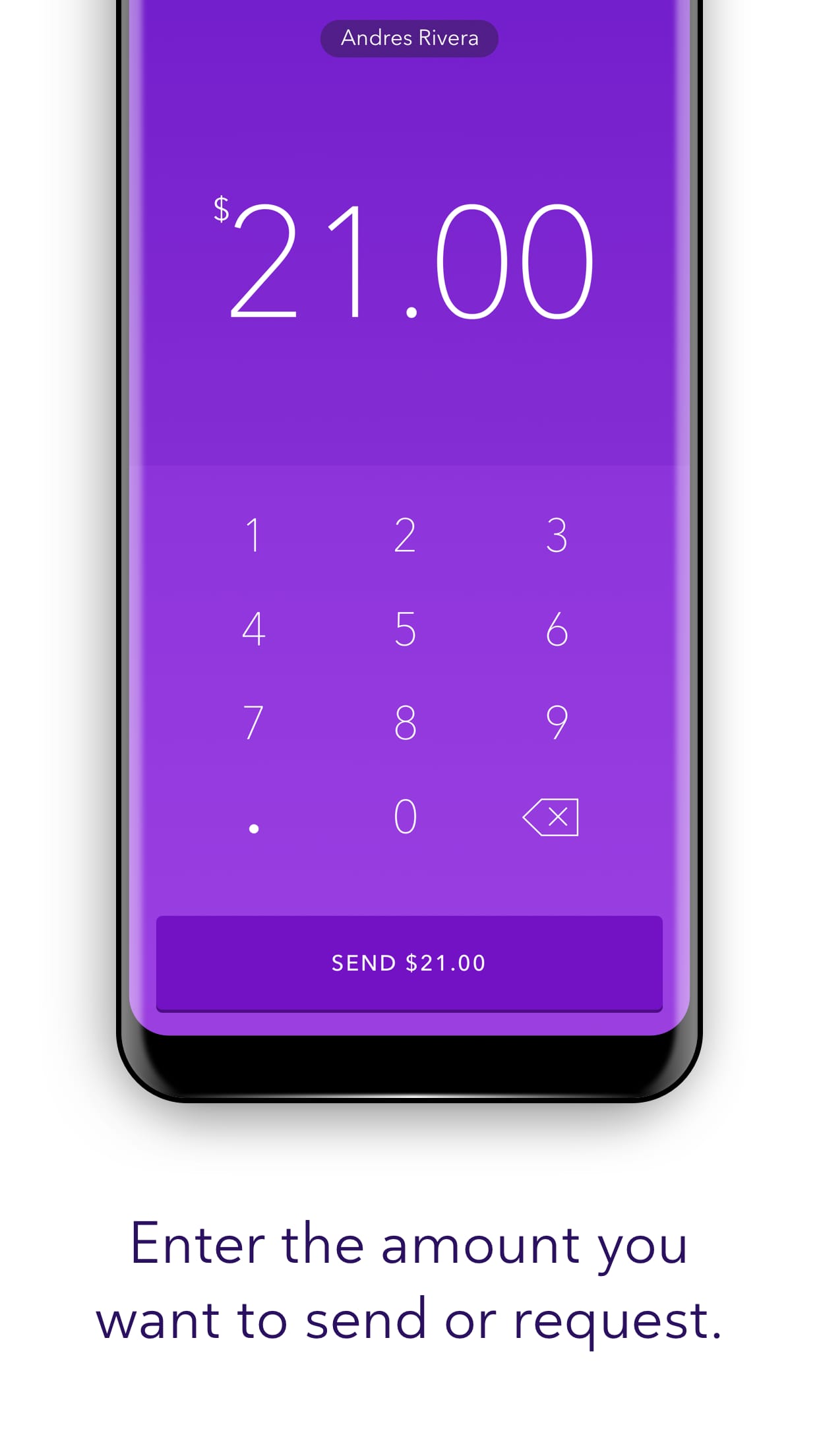

- Simple User Interface: Zelle offers a user-friendly interface that makes sending money a breeze. Users can select recipients from their contacts, enter the desired amount, and complete the transaction within seconds. The straightforward design ensures a smooth and efficient user experience.

- No Additional Fees: Zelle does not charge users any additional fees for sending or receiving money. This makes it an attractive option for individuals looking to avoid transaction fees commonly associated with other payment platforms.

- Secure and Encrypted: Zelle prioritizes the security and privacy of its users. The app employs encryption and authentication measures to protect sensitive information. Users can feel confident that their financial transactions are conducted in a secure environment.

Pros

- Instantaneous Transfers: Zelle’s near-instant transfers allow users to send and receive money quickly, providing a convenient solution for time-sensitive transactions.

- Direct Bank Integration: The app’s integration with participating banks enables users to send money directly from their bank accounts, eliminating the need for additional account setup or third-party intermediaries.

- Wide Network of Participating Banks: Zelle’s extensive network of participating banks ensures that users can send and receive money to and from a large number of individuals, making it a widely accessible payment option.

- Simplified Expense Splitting: Zelle streamlines the process of splitting bills and expenses among friends, making it easy to divide costs and settle payments within the app.

- Enhanced Security Features: Zelle prioritizes user security and leverages the existing security measures of participating banks, providing users with peace of mind when conducting financial transactions.

Cons

- Limited International Availability: Zelle is primarily available within the United States and may not be accessible for international transactions or users residing outside the supported regions.

- Dependence on Bank Participation: Zelle’s usability depends on the participation of users’ banks in the Zelle network. If a user’s bank is not a participating member, they may not be able to send or receive funds through Zelle.

- Transaction Limits and Fees: Zelle imposes certain transaction limits and fees, which may vary depending on the user’s bank and transaction type. Users should be aware of these limitations when using the app.

- Incompatibility with Non-Participating Banks: If a recipient’s bank is not part of the Zelle network, users may encounter difficulties when sending money, as the recipient will need to sign up for Zelle or use an alternative payment method.

- Limited Additional Features: Compared to some other payment apps, Zelle may have fewer additional features and functionalities, focusing primarily on peer-to-peer payments.

Apps Like Zelle

PayPal: PayPal, a widely recognized digital payment platform, allows users to send and receive money securely. It offers international transfers, integration with various online platforms, and a range of additional features.

Cash App: Cash App, developed by Square, facilitates peer-to-peer payments and provides additional features like a Cash Card fordebit card transactions and Bitcoin trading.

Google Pay: Google Pay enables users to send money, make online purchases, and even pay in physical stores using their smartphones. It offers loyalty rewards and integrates with Google’s ecosystem of services.

Screenshots

|

|

|

|

Conclusion

Zelle has transformed the way we handle money transfers, offering a simple and efficient platform for sending and receiving funds. With its instant transfers, broad bank integration, user-friendly interface, fee-free transactions, and robust security measures, Zelle provides users with a convenient and secure solution for their financial needs. While it has certain limitations, such as its focus on the United States and dependency on participating banks, Zelle remains a popular choice for individuals looking to streamline their money transfers.